This explanation, however, is simplistic and misleading for several reasons.

First of all, it must be noted that budget writers started in a giant hole of their own making as a result of a package of new and ill-advised tax cuts that >>drained available revenues.

Second, while it is true that the final budget reinvests in some programs and services to achieve a slight overall increase in General Fund appropriations, this reinvestment was only made possible by using a combination of >>unspent dollars from last year’s budget, budget gimmicks, new tuition increases and fees and significant cuts in other areas of the budget.

Third and most important, however, is the fact that, even with these tactics, state investments in most areas of the budget—including education—are still failing to meet current needs or keep up after years of budget cuts. Here’s why:

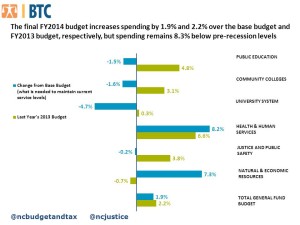

There are two primary vantage points from which to analyze the final budget and make comparisons over time. One method, as noted, is to simply measure the final budget against the actual dollars that were appropriated last year in the FY2013 budget. The other, more useful and informative method measures the final budget against the “continuation” (or “base”) budget, which reflects the dollars actually needed in the next year to maintain current service levels.

Each year, the Governor’s Office of State Budget and Management (which is currently headed by one of the state’s best-known fiscal conservatives, Art Pope) >>collaborates with the various departments and agencies to determine the continuation/base requirements.

So, which vantage point makes for the best comparison?

Hands down, the continuation budget provides a better baseline because it indicates what is actually necessary to maintain the state’s current experience of public service. It does this by accounting for the changing costs required to deliver the same level of services approved by the previous General Assembly. For example, state schools will not confront the same reality that they did in 2012. To account for this, the continuation budget covers education enrollment growth as well as inflation on mandatory expenses such as gas and electricity for state-owned cars and buildings.

The chart below contrasts the final budget to each of these vantage points.

The final budget may invest more than last year’s budget in simple terms of dollars spent but it still falls short of what is needed to maintain current service levels for several major areas in the budget. The reality is that with a diminished baseline, comes diminished expectations. In no area of the final budget is this clearer than in the education budget where adequacy can make or break a child’s ticket to economic mobility.

Even though the budget slightly increases overall K-12 spending compared to last year’s budget, it is noticeably inadequate to meet the overall continuation needs for the K-12 system. That’s why class sizes will likely increase, thousands of teacher assistants will likely face layoffs, teacher salaries will be frozen and even school bus replacement funds will be cut.

We all should be concerned about adequacy because adequate investments can help build economic opportunity for all students. Adequacy matters because class room size matters; every teacher assistant matters; the quality of a textbook matters; professional development for teachers matters. A budget that falls short of what is needed truly matters for students’ classroom experience.

Both of the vantage points discussed above, however, are limited in a historical context. From this perspective, the hard truth is that today, nearly four years into the economic recovery, the final budget falls far short of restoring the damaging cuts from the Great Recession and rebuilding the foundation for sustained economic growth. Deep cuts on top of a growing population—i.e. more children to educate, more seniors to care for, and more citizens to serve and protect—means that state spending is falling further and further behind where it should be. K-12 spending alone is approximately 6.4% or $534 million (FY2008, adjusted) below pre-recession levels.

The bottom line: All North Carolinians want to put the budget on a sustainable fiscal path but we must not allow ourselves to be misled about the simple fact that the new budget puts the state on a path to mediocrity.

Cross posted with permission from >>NC Policy Watch.

>> Tazra Mitchell joined the NC Budget and Tax Center in August 2011 as a Public Policy Fellow. She was promoted to a Policy Analyst in August 2013. Prior to joining the NC Justice Center, Tazra served as an Intern and Legislative Assistant in the Office of State Representative Becky Carney and she worked as a Research Assistant in the non-partisan Fiscal Research Division. Tazra’s policy interests include fiscal policy and human rights, and her work at the Budget and Tax Center focuses on analysis of the State budget, tax policy, and communities of opportunity.

Tazra Mitchell joined the NC Budget and Tax Center in August 2011 as a Public Policy Fellow. She was promoted to a Policy Analyst in August 2013. Prior to joining the NC Justice Center, Tazra served as an Intern and Legislative Assistant in the Office of State Representative Becky Carney and she worked as a Research Assistant in the non-partisan Fiscal Research Division. Tazra’s policy interests include fiscal policy and human rights, and her work at the Budget and Tax Center focuses on analysis of the State budget, tax policy, and communities of opportunity.

Tazra holds a Master of Public Policy from the Sanford School of Public Policy at Duke University and a bachelor’s degree from North Carolina State University.

There are no comments

Add yours